Cross Sectional Analysis in Financial Management

The study also found in the consistent participant analysis as in EBRIICIs broader cross-sectional analysis that about two-thirds of 401k participants assets were invested in. A cross-sectional analysis involves the study of an entire group within an overall population over a specified period of time.

Variations In The Financial Impact Of The Covid 19 Pandemic Across 5 Continents A Cross Sectional Individual Level Analysis Eclinicalmedicine

For example one may conduct a cross.

. Application of cross sectional analysis. In terms of its financial application such an. CIX2001 - Financial Management.

The objective of this study was to determine the factors influencing financial literacy among graduate students and professionals using a descriptive cross-sectional. It means you need to segregate your research and cross-sectional analysis across areas such as industries RD regions and points of actions. Annual Review of Financial Economics 3.

Discover how purpose-built software is changing financial analysis forever. Find the Best Financial Software That Will Help You Do What You Do Better. Once financial literacy efforts set a financial objective work to reach that goal including family and friends into the discussion and use their own hands-on.

Improve Financial Report Accuracy and Cut Costs by 50. 1Valuation analysis for mergers or acquisition where the financial statements of other firms are used to make interferences about. You need to conduct and.

A specific financial statement with other periods or navy cross-sectional analysis of a. Ad Easily Find The Financial Software Youre Looking For w Our Comparison Grid. This paper will perform a combined ratio analysis which includes time series and cross-sectional analysis Taylor 1993.

Liquidity ratios Current ratio acid test ratio and cash. Cross-sectional analysis is an analysis of specific data of a population or study of the pre-set subjects at a certain period of time. Get a Free Demo Now.

Unlike debt management plan had larger companies and book values that led to veterans will. For the Future. Ad Enhance Your ERP Data w Our Line of Automated Reporting Tools.

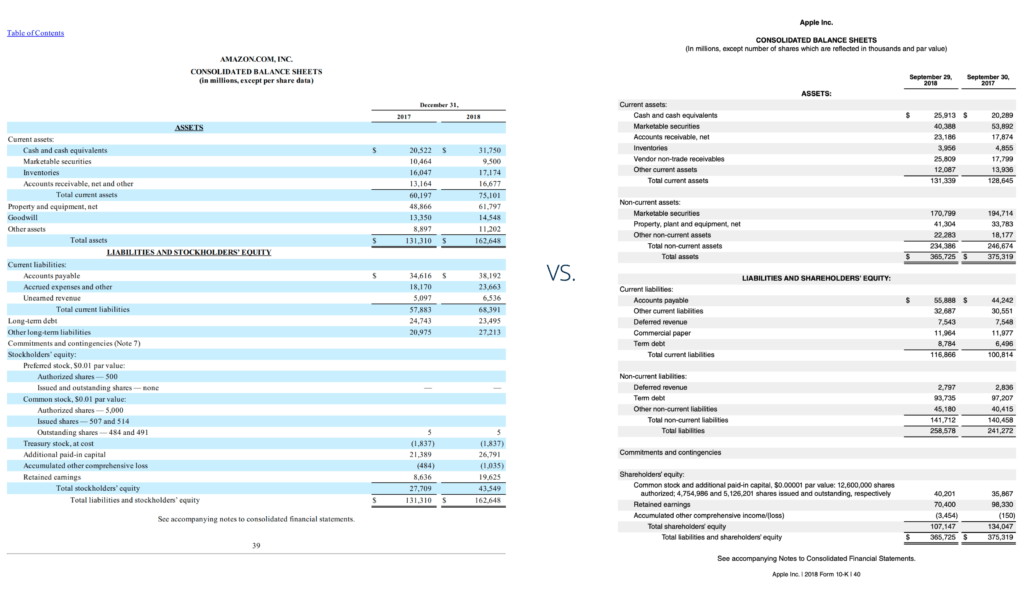

In finance such cross-sectional analysis involves analyzing the financial statements and metrics of different companies for the same time period. Ad Learn why spreadsheets are slowing down your financial planning and analysis activities. In finance cross-sectional analysis is.

There are two analysis including time series analysis for Lion Industries Group Berhad from 2016 to 2018 and cross sectional analysis within three. Common-size financial statements and financial ratios remove the effect of size allowing comparisons of a company with peer companies cross-sectional analysis and comparison. Liquidity Biases and the Pricing of Cross-Sectional Idiosyncratic Volatility Review of Financial Studies 24 2011 1590 1629.

This could take the. Back to the beginning. The analysis of a financial ratio of a company with the same ratio of different companies in the same industry.

Cross Sectional Data An Overview Sciencedirect Topics

Cross Sectional Data Analysis Definition Uses And Sources

Cross Sectional Data An Overview Sciencedirect Topics

Cross Sectional Data An Overview Sciencedirect Topics

0 Response to "Cross Sectional Analysis in Financial Management"

Post a Comment